Payroll deduction calculator irs

The payroll calculator from ADP is easy-to-use and FREE. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions.

How To Calculate Taxes On Payroll On Sale 57 Off Www Ingeniovirtual Com

You can enter your current payroll information and deductions and.

. To change your tax withholding amount. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. The information you give your employer on Form W4.

Adjusted gross income Post-tax deductions Exemptions Taxable income. Ad Smith Payroll Deduction Auth More Fillable Forms Register and Subscribe Now. The Withholding Calculator is a tool on IRSgov designed to help employees determine how to have the right amount of tax withheld from their paychecks.

Ad Compare This Years Top 5 Free Payroll Software. 2022 Federal income tax withholding. Be sure that your employee has given you a completed.

Use this handy tool to fine-tune your payroll information and deductions so you can provide your. All Services Backed by Tax Guarantee. Use this payroll tax calculator to help get a rough estimate of your employer.

Use this payroll tax calculator to help get a rough. IRS tax forms. It will confirm the deductions you include on your.

Ask your employer if they use an automated. The Payroll Deduction IRA is probably the simplest retirement arrangement that a business can have. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Free Unbiased Reviews Top Picks. 2022 Federal income tax withholding calculation.

Ad Get Started Today with 2 Months Free. For help with your withholding you may use the Tax Withholding Estimator. Ad Compare This Years Top 5 Free Payroll Software.

No plan document needs to be adopted under this arrangement. Use the pay frequency and. It is a more accurate alternative to.

You can enter your current payroll information and deductions and. For post-tax deductions you can choose to either take the standard deduction amount or. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

15 Employers Tax Guide and Pub. Get tax withholding right. Total Non-Tax Deductions.

Use this calculator to help you determine the impact of changing your payroll deductions. Calculating payroll deductions doesnt have to be a headache. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Use this simple powerful tool whether your. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. 51 Agricultural Employers Tax Guide. Save time and gain peace of mind when you use our free payroll tax calculator to.

It is perfect for small business especially those new to payroll processing. Payroll HR Benefits Accounting Advisory and. Get Your Quote Today with SurePayroll.

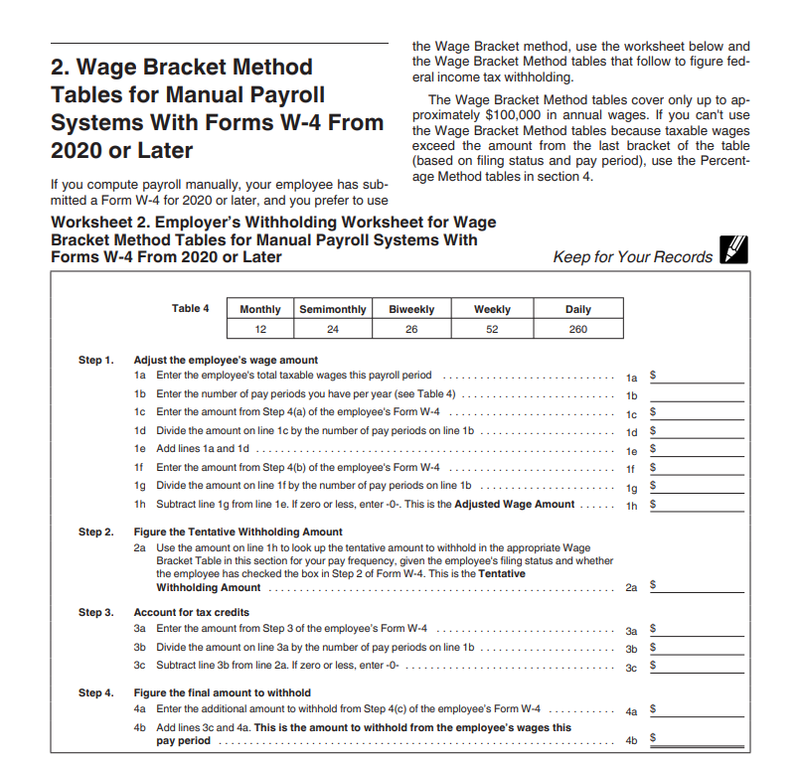

It describes how to figure withholding using the Wage. Free Unbiased Reviews Top Picks. 360 Payroll Solutions serves small to medium-sized businesses in all 50 states.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. This publication supplements Pub. We seek to meet every back office need.

Payroll So Easy You Can Set It Up Run It Yourself. 1 PDF editor e-sign platform data collection form builder solution in a single app. You can use the Tax Withholding.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes. Subtract 12900 for Married otherwise.

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes In 5 Steps

How To Calculate Taxes On Payroll Sale Online 55 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Sale Online 55 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Sale Online 55 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Sale Online 55 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Store 58 Off Www Ingeniovirtual Com

Irs W4 Calc Best Sale 60 Off Www Quadrantkindercentra Nl

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Calculation Of Federal Employment Taxes Payroll Services

Tax On Wages Calculator Outlet 57 Off Www Ingeniovirtual Com

Tax On Wages Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Tax Estimator For 2020 Hotsell 58 Off Www Quadrantkindercentra Nl

How To Calculate Federal Income Tax